When "Buy the Dip" Is Wrong

"Buy the dip" may be the best known rule of investing today, but it doesn't always work.

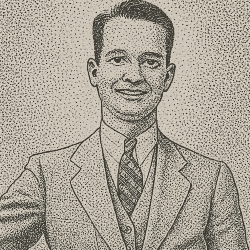

Here's the essence of the 'buy the dip' strategy, from oracle of finance Sir John Templeton:

There will be bear markets about twice every 10 years and recessions about twice every 10 or 12 years but nobody has been able to predict them reliably. So the best thing to do is to buy when shares are thoroughly depressed and that means when other people are selling.

— Sir John Templeton

What this quote overlooks is that, sometimes, the market may never retur to yesterday's trend. Instead, share prices might settle into a new and lower normality.

In Japan's 1990 asset price bubble collapse, its Nikkei Index lost more than half its value between January 1990 to June 1992. Investors including the Japanese government itself bought the dip.

However, a major banking crisis and economic stagnation followed, resetting prices to a new, permanently lower level. The index would go on to lose another 50% of its value and wouldn't return to its prior high for nearly 30 years, in 2024.

Want to read more from Sir John Templeton? Living from 1912 to 2008, he was called by Money magazine the greatest stock picker of the twentieth century. He left behind his plan for a successful life in The Templeton Plan: 21 Steps to Personal Success and Real Happiness.

You can also read his "Templeton maxims" for investing on Franklin Templeton's website for free.

Missed a newsletter? Visit www.mydailyoracle.com for every recent edition, and keep an eye on tomorrow’s inbox as we continue to learn from the great oracles of finance.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter. Quotes may be edited slightly for clarity. Images represent our best effort. Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.