Why It's Risky to Invest in a Revolutionary Technology

Few doubt that AI will be a source of incredible change, but no one knows exactly when that will happen, exactly how, or who will reap the rewards.

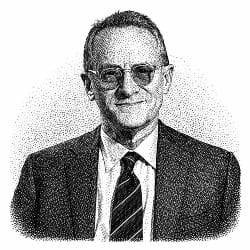

That, in a nutshell, explains the risks of investing in a revolutionary new technology. The early winners in a sector often turn out to be losers for investors. As Marks wrote:

The automobile was probably the most important invention of the first half of the 20th century. If you had seen at the time of the first cars how this country would develop in connection with autos, you would have said, ‘This is the place I must be.’

— Howard Marks

Yet Marks goes on to say that out of the 2,000 companies in the nascent auto sector, only three survived. The auto industry has delivered huge economic benefits to the United States, but it has been terrible for investors.

Artificial intelligence could follow the same trajectory as the auto industry. Today's AI leaders include some of the world’s strongest and richest companies, but new technology is notoriously disruptive. No one knows who will win in the long run.

When the outcome is so uncertain, how do you value a share in an AI upstart that could, just possibly, become a trillion-dollar company?

The potential gains to investors are so great that it leads to what Marks calls "lottery-ticket thinking."

The dream of an enormous payoff justifies – no, compels – participation in an endeavor with an overwhelming probability of failing.

There’s nothing wrong with calculating expected values this way. Venture capitalists engage in it every day to great effect. But assumptions regarding the possible payoffs and their probabilities must be reasonable. Thinking about a trillion-dollar payout will override reasonableness in any calculation.

— Howard Marks

What is the lesson for investors? Tomorrow, we'll find our when we look at how Howard Marks is investing around AI in his own portfolio.

If you want a deeper dive into Howard Marks's thinking, get a copy of the excellent The Most Important Thing Illuminated: Uncommon Sense for the Thoughtful Investor.

We'll learn about AI from Howard Marks every day this week. Watch for tomorrow's story. If you are impatient, read all of my stories about Howard Marks on My Daily Oracle.

✦ Watch for tomorrow’s newsletter in your inbox.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter. Quotes may be edited slightly for clarity. Images represent our best effort. Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.