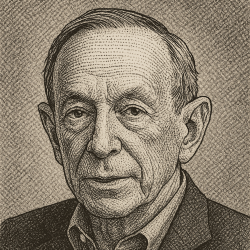

Barton Biggs: The Family Stock-Picking Contest

Our third story this week about Barton Biggs.

He may have predicted the internet bubble, but he flopped at his first chance to manage a stock portfolio. Luckily, that did not derail his future investing career.

Biggs is the model for today's literate, multidimensional, and hugely successful fund managers like Nicolai Tangen. He made his name by successfully predicting the internet bubble would pop in 2000.

But when he got his first chance to manage a portfolio, he failed utterly.

Born into a wealthy family, Biggs studied English and creative writing at Yale. He only got into finance only because he felt left out when his father and brother talked about investing. They were, respectively, a Bank of New York executive and a fund manager.

But Barton's father refused to discuss investing with him until he had read Benjamin Graham's and David Dodd's classic book Security Analysis.

Biggs told of the year his father organised a family stock-picking contest. Barton, his brother Jeremy, and their parents each had to pick five stocks. Biggs' portfolio performed worst, while his mother's delivered the biggest returns.

If you want to read Monday and Tuesday's newsletters about Barton Biggs, you can catch up on them here.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter.

Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.