Ben Graham Advised Investors to Avoid Higher Math

In 44 years of Wall Street experience and study, I have never seen dependable calculations made about common stock values or investment policies that went beyond the most elementary algebra. Whenever calculus is brought in, or higher algebra, you could take it as a warning signal that the operator was trying to substitute theory for experience.

— Benjamin Graham

Benjamin Graham was the father of value investing, and his disciples became some of the best-known, most market-beating investors of all time.

Graham's market experience convinced him that share prices are determined by two factors. Over the long run, the value of a business determines its share price. In the short term, the emotions of the crowd hold sway. After all, the market is often irrational.

He felt that anyone relying on complicated equations and higher mathematics to predict the evolution of share prices is fooling themselves. (Or perhaps they are trying to fool you.)

No equation has ever been invented that can account for intuition, emotions, greed, and fear. And good investors need only basic math to estimate what a business is actually worth and to thus determine what its share price should be.

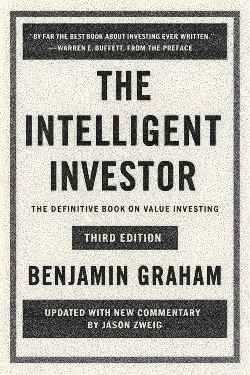

Graham made these comments in his classic book, The Intelligent Investor. It is still worth a read.

✦ Watch for tomorrow’s newsletter in your inbox.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter. Quotes may be edited slightly for clarity. Images represent our best effort. Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.