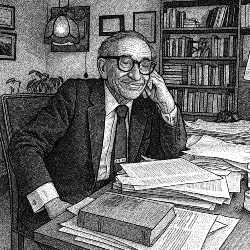

Ben Graham Didn't Flinch

After yesterday's My Daily Oracle, it's important to read today's quote by Benjamin Graham.

Yesterday, he emphasized the importance of investing at fair prices. But Graham goes on to explain that you don't need to try to get the absolute cheapest price. It's OK if prices fall from what you paid, as long as you continue to trust in your analysis of the stock.

If it was a good buy with a margin of safety at the higher price, then it remains a good buy at a lower price. As he put it:

If you can invest your money under fair conditions, I think one certainly should do so even if the market should go down further and even if the securities you buy may also go down after you buy them.

-- Benjamin Graham

This is a critical point for investors who panic when their holdings lose value. A dip doesn’t mean you made a mistake.

Graham’s reassurance is simple logic: if your original valuation was sound and your margin of safety real, then a cheaper price just improves the deal.

Many of Graham’s most successful investments, including GEICO, saw temporary declines before paying off. He didn’t flinch. He waited. The market eventually aligned with the math.

The lesson isn’t just to buy at fair prices. It’s to hold with conviction when those fair prices get even fairer.

Well, today's story ends this week's Ben Graham focus. Catch up on anything you missed at MyDailyOracle.com. And stay tuned, because next week we'll go back in history to take a special look at Niccolò Machiavelli's advice for investors.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter. Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.