Ben Graham on Beating the Big Boys

With a few exceptions (I'm looking at you, LVMH Moët Hennessy MC.PA), my portfolio is up this year to date. Even so, I feel like I've lived through a decade of anxiety.

If you're tempted to hand off selecting your investments to a portfolio manager somewhere, keep in mind the following words of wisdom from the father of value investing:

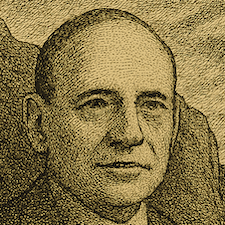

I am convinced that an individual investor with sound principles, and soundly advised, can do distinctly better over the long pull than a large institution.

-- Benjamin Graham

In his influential books, Security Analysis and The Intelligent Investor, Graham laid the groundwork for the value investing principles that still serve investors well today.

Graham's approach focuses on:

- Fundamental analysis: Analyze the financial health and performance of companies you're considering.

- Identify undervalued stocks: Look for those whose stock prices are lower than what you deem their intrinsic value to be.

- Long-term investment: Then hold your investments for the long term, at least until they appreciate.

Of course, as Warren Buffett has said many times, if you don't have time to manage your investments yourself, low-fee ETFs can be an excellent choice.

During the rest of this week, we will get more insights from the brilliant Benjamin Graham. Stay tuned.

(And don't forget what happened to Suze Orman when she gave her money to a reckless financial advisor.)

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter.Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.