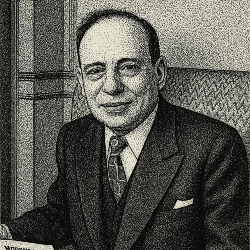

Ben Graham Says Good Isn't Good Enough

Warren Buffett once said Charlie Munger taught him to buy “wonderful companies at fair prices.” That second part, the price, matters more than most investors admit.

On March 24, 2000, at the peak of the dot-com bubble, Amazon was trading at 19 times sales. Microsoft was at 26 times. eBay, a staggering 171 times. These were undeniably good companies. But if you bought them at those prices, you lost—at least for a long time.

Benjamin Graham put it simply:

It is easy, of course, to pick out good companies… But that is not the same thing as picking out good stocks to buy at their current prices.

After the crash, it took nine years for Amazon to climb back to its March 2000 price. eBay took four years. Microsoft, the slowest of the three, needed sixteen years to recover.

The lesson is clear. Buy companies you admire, but only at prices that make sense. Until then, keep them on your watchlist. Good isn’t good enough when it’s overpriced.

Today's story marks the fourth day of this week's Ben Graham focus. If you missed the first three, you still have time to read them at My Daily Oracle.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter. Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.