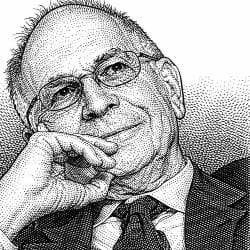

The Big Short's Steve Eisman: Why This Famous Bear is Now Bullish on America

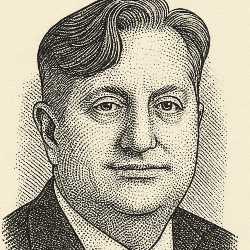

Steve Eisman is a famously contrarian bear who made $700 million shorting the housing market in 2007, but today he is a big believer in the U.S. economy:

The U.S. economy is the most dynamic of any developed country. And I'll give you an interesting statistic that I just looked up the other day. Nvidia today passed $5 trillion and Apple and Microsoft are just past four each. The largest market cap of any company in Europe is not even $500 billion. So, to me, if you're going to invest, you're going to invest here. I don't see any point in investing overseas.

— Steve Eisman

Note that the market cap Steve mentions here may have changed since he spoke.

When Steve Eisman was an analyst, he was known for being cynical about the prospects of many of the companies he covered. He told one CEO that his company's investment documents were "toilet paper."

Later, as one of the few investors who predicted the 2007 crash, Eisman was featured in Michael Lewis's book and the subsequent movie, The Big Short. (He was played by Steve Carell.)

Eisman admits the economy is K-shaped, meaning that even as some are getting better results (the top arm of the 'K'), for others, the trend line is falling (the bottom arm of the 'K').

Listen to Steve Eisman's comment on his recent presentation at Case Western Reserve University in Ohio. Or get The Big Short. It's a great read, and the audiobook is even better.

✦ Watch for tomorrow’s newsletter in your inbox.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter. Quotes may be edited slightly for clarity. Images represent our best effort. Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.