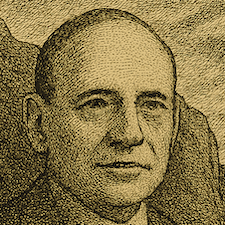

Ben Graham: Buy in less favorable conditions

The man who is sure improvement is coming can buy on the basis of current less favorable conditions, and thus derive the full benefit of the betterment — if it materializes.

– Benjamin Graham

Today's Oracle Bio:

Benjamin Graham was the father of value investing and Warren Buffett's mentor and inspiration. Graham pioneered the use of metrics like price-to-earnings (P/E) ratios, debt-to-equity ratios, and dividend records. His investment firm, Graham-Newman Corp., significantly outperformed the market with returns of more than 20% annually between 1936 and 1956.

Book Highlight:

To read about Graham, start with his book, The Intelligent Investor. Warren Buffett calls it "by far the best book about investing ever written." Enough said.

If, after reading that, you want more, I suggest his other book, Security Analysis: Principles and Techniques. He first published it in 1934 and it has become one of the most influential financial books ever written. The latest edition includes updates on value investing by James Grant, Roger Lowenstein, Howard Marks, and others.

Thought of the Day:

Even as the market looks increasingly unstable, we can find reassurance in these words from the legendary Ben Graham. As long as you believe in the inherent value of the companies whose shares you buy, you can expect to profit when their prices recover.

Graham was a big believer in using your own analysis to estimate fair share prices. He also advised not to worry whether you're buying at the absolute bottom, or if the price might swing lower after you purchase. As long as you can get the shares at a big enough discount from your fair price to provide a margin of safety, you have done your job.

He never said "buy the dip," but he may have inspired it.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult with a qualified financial advisor before making any investment decisions.

Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.