Does Crypto Actually Work?

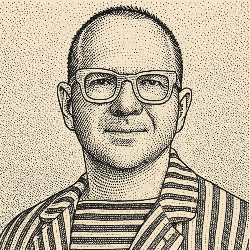

Steve Eisman is the Wall Street legend who earned about US$750 million in profits for his hedge fund by betting against Wall Street banks in the 2008 financial crash. (Steve Carell played Eisman in the movie, The Big Short.)

Here, Eisman explains that cryptocurrency doesn't work the way it should:

When you talk to the cryptomaniacs and you ask them, "Why do you own crypto?" they all basically have the same rationale, which is that all this government spending that has taken place has debased government currencies, and so you should own some crypto as a hedge. But correlation between NASDAQ and crypto is still high. That's that's my problem with crypto.

— Steve Eisman

In fact, crypto tends to rise and fall with the NASDAQ, rather than in opposition to it. As Eisman says, "On days where interest rates are going up and NASDAQ is going down, crypto should go up," but it doesn't.

Research from Nasdaq backs Eisman up. It shows the long-running correlation between Bitcoin and the Nasdaq-100 is about 0.8, and the two move in the same direction at the same time.

That means Bitcoin behaves like a high-risk tech asset, not a hedge against inflation.

If cryptocurrency doesn't protect investors against the debasement of fiat currencies, then what is it for? That's exactly Eisman's point.

To better understand Eisman's comments, watch the video on YouTube.

Better yet, buy Michael Lewis's book, The Big Short: Inside the Doomsday Machine, which describes how Eisman and other investors tried to raise the alarm in the runup to the Global Financial Crisis and profited from betting against the big investment banks. Both infuriating and hilarious, The Big Short is one of the best books about finance ever written.

✦ Watch for tomorrow’s newsletter in your inbox.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter. Quotes may be edited slightly for clarity. Images represent our best effort. Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.