Don't Get Fleeced by High Fees

Investors are still paying excessive fees to the managers of the mutual funds where they park their money. One reason investors are still getting fleeced is that excessive fees sometimes seem quite small on the face of it.

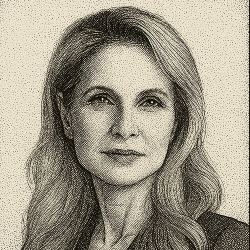

Magda Wierzycka pointed out in a recent post on MyDailyOracle.com that management fees exceeding 1% are too high.

It's true that fees have been dropping across the industry. Yet, many funds still charge higher fees than Wierzycka's rule of thumb. The average expense ratio is 1.61% for small cap funds and 1.45% for large-cap funds.

The example I used in my earlier story about Wierzycka was an investment of $80,000 over 25 years at a 7% return. If you are charged an annual fee of 2% instead of 0.5%, at the end of the investment period you end up $271,000 instead of $386,000.

To put it another way, the 1.5% difference in fees cost you $115,000.

Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it.

— Albert Einstein

Einstein is right that compounding gains are a powerful force, and that's the problem with high fees. Fees redirect the benefits of compounding away from you, the investor, and towards the managers who are exploiting you.

And that brings us to this slightly extended quote from Wall Street legend Peter Lynch. Remember the old story about the Indians of Manhattan supposedly selling all their real estate in 1626 for $24 in trinkets and beads? Lynch points out that the Indians might have made the better investment. If they had invested that $24 at 8% and let it compound over all those years, it would be worthy around $30 trillion today. That contrasts to just $28.1 billion for all the real estate in Manhattan.

What a difference a couple of percentage points can make, compounded over three centuries.

— Peter Lynch

Read more from Peter Lynch in One Up On Wall Street: How To Use What You Already Know To Make Money In the Market. Investors have bought more than one million copies of this seminal book on investing. It highlights the advantages that average investors have over Wall Street professionals.

Visit www.mydailyoracle.com for more insights from the world's greatest financial oracles. And watch your inbox for the next post.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter. Quotes may be edited slightly for clarity. Images represent our best effort. Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.