Edwin Lefevre Says Watch the Clock

Speculators buy the trend; investors are in for the long haul. One reason people lose money today is that they have lost sight of this distinction; they profess to have the long term in mind and yet cannot resist following where the hot money has led.

— Edwin Lefevre

Lefevre wrote those lines more than a hundred years ago, yet they sound like something an expert said yesterday afternoon on CNBC.

Most of what you hear, in the media or from other investors, is short-term in nature. It's about what stocks will do today, this week, or next month. Even analyst reports focus on the relatively short term.

For day traders and speculators, that is just fine. They are gambling for a large payday based on events they expect to happen on a relatively short time frame.

If you are an investor, however, the short term is just a distraction.

Are you trying to save and grow your money so you can buy a house, pay for your kid's education, or retire one day? If so, then you operate by a very different clock than most of the financial industry.

Pain results when a marathon runner tries to sprint. A long-term investor throws their money into a momentum trade, buying a stock just because its share price has been going up.

The factors pushing a share up in the short term may have no relevance over a years-long holding period. Investors who pay too little attention might get stuck with that stock long after its short-term run has ended.

Speculators and investors are both legitimate players, but they respond to different signals and operate according to different calendars.

Lefevre is suggesting that investors ask themselves which time horizon applies to them. If the answer is days or weeks, then a fast exit plan matters more than doing a deep dive into the balance sheet. If years, then you might consider daily and even quarterly price swings to be just background noise.

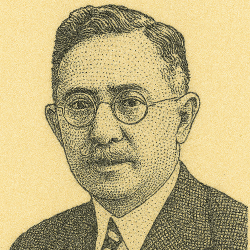

Edwin Lefevre worked as a trader and wrote eight books. His Reminiscences of a Stock Operator has been called the most entertaining book ever written on investing. Even though Lefevre published it in 1923, it is fresh, informative, and hilarious.

You can get the book for next to nothing as a Kindle book, audiobook, or in print. (Use the money you save to buy some Berkshire Hathaway.)

If you like this post, come check out the ones you have missed at www.mydailyoracle.com, and look out for tomorrow’s note in your inbox.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter. Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.