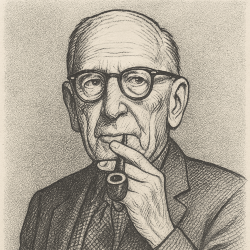

Fred C. Kelly on Catching Turkeys

Even in bull markets, most of us don’t come out ahead. That’s not due to a lack of information. Often it’s not even bad luck. It’s us and our emotions.

Early 20th-century homorist and writer Fred C. Kelly put it simply:

It is human to have vanity, to be reluctant to admit that one has behaved foolishly, and vanity is one of the worst foes to a man trying to make money in the market.

— Fred C. Kelly

We take pride in small wins. We grab a gain and rush to claim the credit. "I’m clever," we tell ourselves, because "I can now sell this stock for more than I paid for it."

But if the price rises higher after we sell, we chase it by buying it again.

Then, when a share price drops, we wait. We tell ourselves the decline is temporary and that we were right in the first place. By now, though, we’re no longer investing. We’re just defending our ego.

Kelly tells the story of a turkey trapper from his boyhood:

The trap was a wooden box, propped open by a stick and twine. Corn led a trail to the trap, where more corn waited inside. When enough turkeys wandered in, the trapper would yank the string and drop the door. One day, twelve turkeys went in. The trapper hesitated. One bird wandered out. "I'll wait a minute and maybe the other one will go back." he said. Then two more walked out. "I should have pulled the string at eleven," he muttered. More birds left. Still he waited. "I can't go home with less than eight. Some will come back." Finally, only one turkey remained. "I'll wait until he leaves or another enters," the man said to himself. The last turkey walked out and the man returned empty-handed.

— Fred C. Kelly

Perhaps you have seen a stock touch $80 and then hesitated to sell at $78. Then $75. Then $70. And by the time we finally acted at $65, we asked ourselves: Why didn’t I pull the trigger sooner?

If you're a wise investor today, then seeing the price of a company you're watching fall from $80 to $65 might be more of a buying opportunity than a reason to sell. As long as you have good reason to believe in the underlying value of the company, then a lower price simply means you have a bigger margin of safety.

But Kelly was writing in 1930, in his classic book, "Why You Win or Lose: The Psychology of Speculation." I am not saying there’s a right moment to sell. But maybe there’s a wrong reason to hold.

Want more reflections like this one? Visit www.mydailyoracle.com for anything you may have missed—and watch your inbox for the next post.

And if you enjoyed this post, Fred C. Kelly's classic, Why You Win or Lose: The Psychology of Speculation, is enjoyable and still relevant today. Kelly was also a close friend of the inventors of human flight, and their official biographer. His book, The Wright Brothers: A Biography, is called the best book ever written about Wilbur and Orville Wright. It costs just $0.99 in its Kindle edition.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter. Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.