Goldman Sachs CEO: Expect a Crash Within Two Years

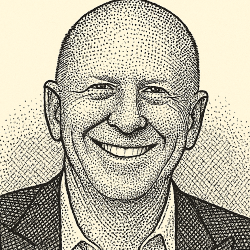

You should expect a significant market crash within the next two years, says David Solomon, the CEO of Goldman Sachs, an investment bank.

Solomon made the forecast at a financial industry event in Hong Kong last week. His exact words were:

Of course, it is likely there’ll be a 10% to 20% drawdown in equity markets sometime in the next 12 to 24 months. And I’d say there are very few people in this room that don’t think that that’s a meaningful possibility.

— David Solomon

In the past 150 years, there were 19 bear markets that took the market down by at least 20%, according to Paul Kaplan, an analyst and researcher.

That's about one every 8 years.

Even so, during that time, one invested dollar turned into $33 inflation-adjusted dollars.

So, what does this history tell us about investing during volatile markets? Mainly, that it's worth doing.

When there is a crash, whether in two years or next week, we won't know in advance how severe it will be, nor how long it will last.

If history is any guide, however, long-term investors who can withstand the pain should stay the course and not panic. As Kaplan says:

For investors who can stay in the market for the long run, equity markets still continue to provide rewards for taking these risks.

— Paul Kaplan

✦ Watch for tomorrow’s newsletter in your inbox.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter. Quotes may be edited slightly for clarity. Images represent our best effort. Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.