How Investors Should Deal With Greed, Ambition, and Acts of God

There is no such thing as a final answer to security values. A dozen experts will arrive at 12 different conclusions. Market values are fixed only in part by balance sheets and income statements; much more by the hopes and fears of humanity; by greed, ambition, acts of God, invention, financial stress and strain, weather, discovery, fashion and numberless other causes impossible to be listed without omission.

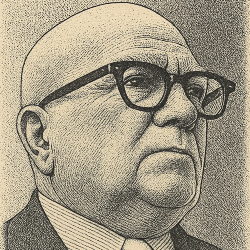

— Gerald Loeb

Loeb had 40 years of financial experience, was called the "most quoted man on Wall Street", and co-founded and led E.F. Hutton, which became the United States' second-largest brokerage under his leadership.

He wrote the above words in his book, The Battle for Investment Survival, in 1935, just five years after the market crash that had brought the world into the Great Depression. Loeb managed to avoid losses in the Great Crash of 1929.

Loeb contrasted applying guidelines for valuing a security to using the rules of physics to build a bridge. While an engineering student will find that "an answer based on sound principles always holds," an investor must rely on more ambiguous rules.

Loeb believed the best investors admitted their weaknesses and educated themselves about the market. "There is no line of endeavor where real knowledge will pay as rich or as quick a monetary reward as Wall Street," he concluded.

The Battle for Investment Survival is available for just $0.99 as a Kindle ebook. Grab your copy and learn from a master.

✦ Watch for tomorrow’s newsletter in your inbox.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter. Quotes may be edited slightly for clarity. Images represent our best effort. Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.