How to Beat the 'Mother of All Biases' Before It Wrecks Your Portfolio

Americans are so overconfident as a group that 93% of them claim to be a better drivers than the median person. Now, that is statistically impossible.

But the problem doesn't stop with driving. It extends to investing, too. It can cost you a fortune. In this post we are going to learn how to beat it.

Why do you think the Titanic sank? Overconfidence. (Oh, and the small matter of an iceberg.)

The Chernobyl nuclear accident? Overconfidence again.

And more importantly for investors, overconfidence was also a major factor behind the subprime mortgage crisis of 2008 and the subsequent Great Recession.

I like to think I'm a rational investor, but I'm probably just deluding myself.

Believe it or not, the same is true of you. Behavioral economists have proven this again and again.

Oracle of Finance Warren Buffett blamed overconfidence for getting him into the worst deal he ever made, buying Dexter's Shoe Company with Berkshire Hathaway stock instead of cash. It cost him billions.

If even Buffett can fall prey, is there anything we everyday investors can do to protect ourselves from overconfidence?

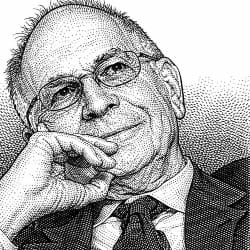

The man whose research made possible the "Moneyball" style of managing baseball teams that Brad Pitt made famous in his movie said this about investor overconfidence:

“The combination of a clear hypothesis about the future and a large investment is the perfect storm for creating overconfidence.”

— Daniel Kahneman

Research shows two things you can do to beat overconfidence.

"Trade less" is the best advice. Market researchers have found that individual investors tend to buy and sell stocks more even than Wall Street pros. Unfortunately, the more they trade, it turns out, the more money they lose.

If you're male, another piece of advice might be to hand the finances over to a female in your life. Other research found that men trade 1.5 times more than women on average, and their returns are far lower.

Yikes. That's not good for the male ego.

For a deep dive into the impact of overconfidence on investors, look at the paper, "Overconfident Investors," prepared by Kent Danielt and David Hirshleifert.

And if you want a longer tome on the topic of how humans think, then you must read Thinking, Fast and Slow by Daniel Kahneman. It's one of the great books of the 21st century.

✦ Watch for tomorrow’s newsletter in your inbox.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter. Quotes may be edited slightly for clarity. Images represent our best effort. Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.