Howard Marks Hates Las Vegas

In investing, success depends on how much you gain when you're right, but also on how well you survive when you're wrong.

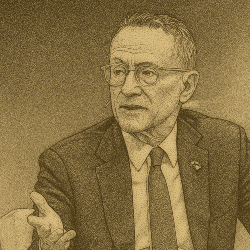

That’s why Howard Marks, self-made billionaire, co-founder of Oaktree Capital, and one of the world’s most respected investors, says the most important thing is being leery of leverage.

Marks admits that leverage can amplify your wins, but it just as surely magnifies your losses. And when losses come, they often arrive faster and harder than expected.

There's nothing magic about leverage. It increases upside potential, but it also reduces or eliminates the margin of safety. Leverage is just an application of the Las Vegas maxim, “The more you bet, the more you win when you win.” But I think people tend to omit “. . . and the more you lose when you lose.”

— Howard Marks

To read more insights from Howard Marks, visit www.mydailyoracle.com. And keep an eye out for the next issue in your inbox.

If today’s post resonated with you, Howard Marks explores this and other timeless principles in his book, The Most Important Thing: Uncommon Sense for the Thoughtful Investor. It’s essential reading for anyone serious about building lasting wealth.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter. Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.