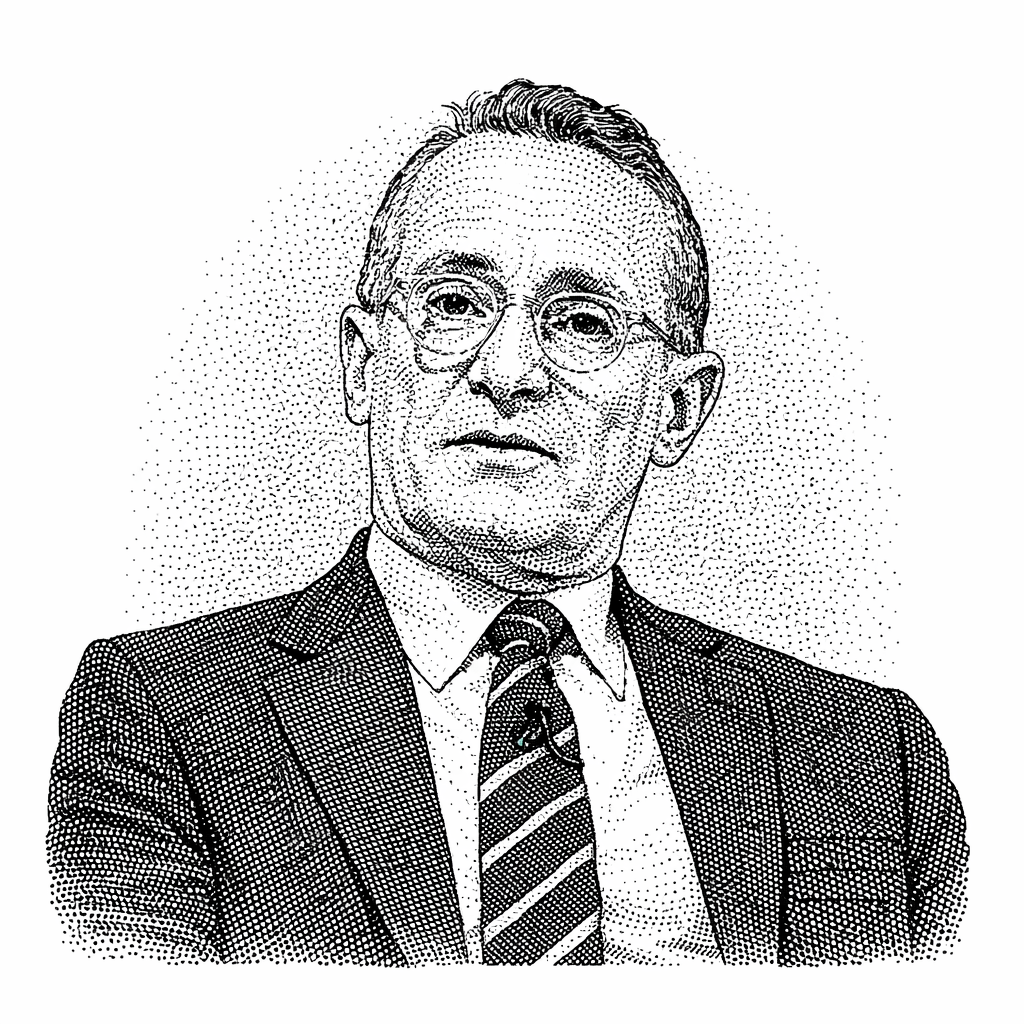

Howard Marks: This Is What Bubbles Always Look Like

Every major market bubble follows the same script. Legendary investor Howard Marks, whose returns have doubled the S&P 500, has seen it play out again and again.

He says the warning signs are always visible, if you're paying attention:

One of the most interesting aspects of bubbles is their regularity in terms of the progression they follow.

Something new and seemingly revolutionary appears, and the excitement is overwhelming. The early participants enjoy huge gains. Those who merely look on feel incredible envy and regret and, motivated by the fear of continuing to miss out, pile in. They do this without knowledge of whether the price they’re paying can possibly produce a reasonable return with a tolerable amount of risk.

The end result for investors is inevitably painful.

— Howard Marks

You might think bitter past experience would discourage later investors from repeating the cycle when the next bubble forms, but Marks says that hasn’t happened yet. He's sure it never will.

As he writes, "Memories are short, and natural risk aversion is no match for the dream of getting rich on the back of a revolutionary technology."

So for Marks, one sign of a bubble is investors buying hot stocks at any price. Some observers believe that is already happening. That's the perception behind 'Big Short' investor Michael Burry's decision to short mega AI stock Nvidia.

So, what do you believe? Are we in the classic bubble market Marks described? Or are investors in AI leaders still making careful calculations of risk and reward?

If you enjoy Mark's brilliant analysis, you can read more My Daily Oracle posts about him here. Or wait for tomorrow's My Daily Oracle, which will look at what Marks has to say about the dark cloud of debt looming over the AI boom.

For a deeper dive into Marks' wisdom, get a copy of The Most Important Thing Illuminated, Uncommon Sense for the Thoughtful Investor. It distills years of his thinking into a single book, with counterpoints from four other renowned investors.

✦ Watch for tomorrow’s newsletter in your inbox.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter. Quotes may be edited slightly for clarity. Images represent our best effort. Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.