Ben Graham: More of one means less of the other

— Benjamin Graham

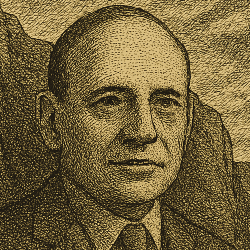

Who Was Benjamin Graham?

Benjamin Graham was the father of value investing and Warren Buffett's mentor and inspiration.

In large part thanks to Warren Buffett's tireless advocacy of Graham, he has joined the pantheon of greats. Yet, he was considered unconventional during his lifetime.

In his iconaclastic manner, he once said, "You have the choice between tossing coins and taking the consensus of expert opinion, and the results are just about the same in each case."

Graham pioneered the use of metrics like price-to-earnings (P/E) ratios, debt-to-equity ratios, and dividend records. His investment firm, Graham-Newman Corp., significantly outperformed the market with returns of more than 20% annually between 1936 and 1956.

Learn More:

To read about Graham, start with his book, The Intelligent Investor. Warren Buffett calls it "by far the best book about investing ever written." Enough said.

If, after reading that, you want more, I suggest his other book, Security Analysis: Principles and Techniques. He first published it in 1934 and it has become one of the most influential financial books ever written. The latest edition includes updates on value investing by James Grant, Roger Lowenstein, Howard Marks, and others.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter.

Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.