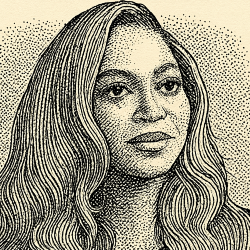

Music Royalties: How to Get Paid Whenever Beyoncé Gets Played

Bruce Springsteen’s catalogue throws off $17 million a year in royalties, which are payments made for the use of his songs. Big investors capture that income today, but regular retail investors can now buy slices of similar royalty streams.

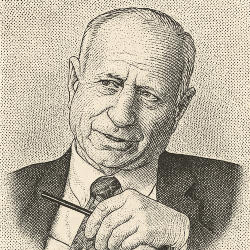

To explain how it works, today's Oracle of Finance is Merck Mercuriadis. He is the former manager of Elton John, Guns N’ Roses, Morrissey, Iron Maiden, and Beyoncé, and the creator of one of the biggest song funds in existence.

When a song becomes proven, the earnings pattern to it becomes very predictable, and is therefore investable. And these songs are as valuable as gold, or oil. In a post-Donald Trump world, what investors want is something that’s uncorrelated to everything else that’s going on in the marketplace. Songs stay in the marketplace, stay working for you, and as they get older, they become more valuable.

— Merck Mercuriadis

Selling their future income streams delivers an instant payday for artists, producers, and songwriters. Musician The Weeknd is reportedly in talks to raise $1 billion this way.

The buyers benefit as well by obtaining a somewhat predictable long-term income stream and the option to resell it in the future.

Mercuriadis only sells the bonds he has created to institutional investors, but retail investors have other options. For one, they can invest in two publicly traded companies that are significant beneficiaries of copyright income: Universal Music Group (UMG.AS) and Warner Music Group (WMG). Both pay dividends of more than 2.2%.

They can also buy royalty payment rights from a marketplace like RoyaltyExchange. (Remember, RoyaltyExchange and platforms like it are not regulated financial exchanges, so they carry extra risk.)

At the time of publication, royalties for music by Beyoncé, Major Lazer, Drake, and Justin Bieber are for sale on the platform at prices higher than 10 times what they paid out over the last 12 months. This income is unlikely to be harmed by interest rate or stock market fluctuations. If you're seeking diversification, it might be the ultimate uncorrelated asset.

On the other hand, the stability of their long-term future income might not be as predictable as boosters say. That could make paying 10x last year's royalties a steep bet.

✦ Watch for tomorrow’s newsletter in your inbox.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter. Quotes may be edited slightly for clarity. Images represent our best effort. Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.