How NVIDIA Funds Customers to Inflate Its Share Price

Artificial intelligence valuations have gotten so high that company leaders like NVIDIA's Jensen Huang have resorted to investing in their own customers as the only way to keep inflating the balloon.

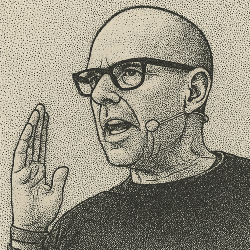

Scott Galloway (tech CEO, NYU business professor, and podcaster) breaks down the controversial math for today's My Daily Oracle.

His quote may seem long at first, but stick with it because it's worth it:

NVIDIA invests 100 billion in OpenAI, with the agreement that they're going to turn around and spend all of that $100 billion on NVIDIA chips. They're trading at $4 trillion, so they're taking 2.5% of their company for that $100 billion to invest in OpenAI.

That money comes right back in the form of chip purchases. The operating margin on the GPUs that NVIDIA sells is about 55 points. So that creates $55 billion in incremental earnings or profits. The company trades at a PE of about 33. So loosely speaking, that's about a $1.8 trillion increase in market cap. So a $1.8 trillion increase in market cap off of a $100 billion investment is a 1700% return. Theoretically, it's a wildly accretive thing to do.

— Scott Galloway

Because shareholders consider NVIDIA to be worth about 33 times its earnings, every dollar of new earnings adds $33 to the company's market cap. NVIDIA can shoot its share price to the moon by giving its customers money to buy its products.

After expenses, for every dollar they give away, they end up with 55 cents in profit. That would be a losing proposition, except this result adds a net of $17 to NVIDIA's market cap.

These circular, zero-sum deals raise a fundamental question: Can AI companies ever deliver real, non-engineered returns worthy of their sky-high valuations? Funding your customers to buy your product is, to put it mildly, not a sustainable business strategy.

There's another risk, too. Circular deals create tightly-linked valuations. If one AI company's price begins to deflate, the shared risk could accelerate a downward spiral across the entire sector.

To learn more, listen to the Pivot Podcast where Galloway made these comments. The discussion starts at around the 17 minute mark. You can also check out this summary of the NVIDIA/OpenAI deal on Yahoo Finance.

For Galloway's latest finance book, which is a best seller, pick up The Algebra of Wealth: A Simple Formula for Financial Security.

✦ Watch for tomorrow’s newsletter in your inbox.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter. Quotes may be edited slightly for clarity. Images represent our best effort. Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.