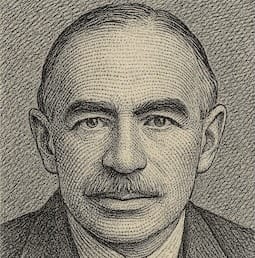

Keynes: Anticipating the anticipations

— John Maynard Keynes

John Maynard Keynes was an academic who nonetheless managed to build up a personal fortune and helped set in place the monetary system that would lift a billion out of extreme poverty.

Early in his career, Keynes went through a phase of speculative investing. He called it "credit cycle investing," but the phrase for it today is "momentum investing."

This quote from the time shows he felt he could in fact regularly anticipate turns in the market, but he later painfully learned it was more difficult than he at first believed.

Keynes lost 80% of his net worth in 1928 when his speculations in rubber, corn, cotton, and tin went wrong, and the Great Crash of 1929 wiped out most of his assets that remained. In future editions of My Daily Oracle, we'll look at how he matured as an investor and climbed out of that hole in the midst of the Great Depression.

The Life of John Maynard Keynes

The Financial Times rated him as "one of the few economists with the practical ability to make money," and he was called “arguably the most astute observer of the investment game that ever lived.” He made his wealth through investing and the occasional art purchase and left behind the present-day equivalent of $30 million upon his death.

Keynes was also a fund manager. While administering the Cambridge college fund, he recorded a twelve-fold increase in its value. Meanwhile, the broader market averages didn't even double during the same period.

In his public roles, Keynes helped create the post-World War II Western-led international economic system that had lifted over 1 billion people worldwide out of extreme poverty. His ideas were the dominant strain of postwar economics in the West.

Keynes was also glamorous and a key member of the sexually and intellectually liberated Bloomsbury set. He was a best-selling author, husband of a world-famous Russian ballerina, ennobled member of the House of Lords, and midwife to the IMF and the World Bank.

Value investors like Warren Buffett consider Keynes to be their forebearer, and he crystallized many of the ideas they rely on. Keynes played a pioneering role in advocating common stocks (equities) as sound investments. It was a difficult battle at a time when institutional investors preferred government bonds and fixed-income securities.

Recommended Reading

To learn what Keynesian insights you can apply to your portfolio, read the enjoyable and elegant Investing with Keynes: How the World's Greatest Economist Overturned Conventional Wisdom and Made a Fortune on the Stock Market, by Justyn Walsh.

Of Keynes' own works, I suggest starting with his General Theory of Employment, Interest, and Money. Paul Krugman calls it "nothing less than an epic journey out of intellectual darkness" and "a book for the ages." He says, "Read it, and marvel."

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter.

Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.