Joel Greenblatt: Long term smart, short-term...

– Joel Greenblatt

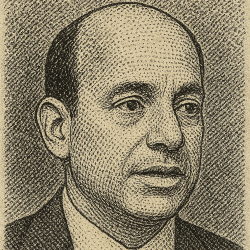

Who Is Joel Greenblatt?

Joel Greenblatt achieved extraordinary returns as a fund manager, with an annualized rate of about 50% from 1985 to 1994. He specializes in value investing and 'special situations' like spin-offs and mergers. His net worth was estimated to be around $500 million as of 2023.

Greenblatt tries to buy companies below their true value using what he calls his "magic formula." This involves screening for stocks with low P/E ratios ("cheap stocks") that also achieve high returns on capital ("good companies").

Warren Buffett has said he only buys stocks he'd be happy to hold for life. Greenblatt, on the other hand, suggests holding shares in 20-30 such companies and then selling them after a year.

At that point, you screen again and fill out your portfolio with another batch of companies that are currently cheap and good.

If you want to try Greenblatt's system, go to his free website, magicformulainvesting.com. There you can screen stocks with his criteria and choose the ones you want to invest in.

Learn More:

Greenblatt's most popular book is The Little Book That Still Beats the Market (affiliate link). Unlike many finance books (I'm looking at you, Benjamin Graham), it's a fun and fast read and has become one of the classics of finance literature. More than 300,000 copies in print.

Greenblatt's other books are equally readable, commonsensical, and informational. They are:

• You Can Be a Stock Market Genius: Uncover the Secret Hiding Places of Stock Market

• The Big Secret for the Small Investor: A New Route to Long-Term Investment Success

• Common Sense: The Investor's Guide to Equality, Opportunity, and Growth

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions.

Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.