The Less You Rebalance, The More You Have

The less you rebalance, the more you're going to have, because you're always selling the better performers. For as long as I can remember, I've used the phrase "stay the course" to urge investors to invest for the long term and not be diverted by the daily sound and fury of the stock market. You want to get out of the idea that you always have to do something. So, don't do something, just stand there.

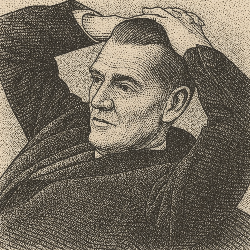

— Jack Bogle

John “Jack” Clifton Bogle revolutionized investing in 1976 when he launched the Vanguard 500 Index Fund, the first mutual fund designed for individual investors to track a market index. At the time, the idea of passive investing was ridiculed. Critics called the fund “Bogle’s Folly.”

But the idea caught on. From essentially 0% in 1976, the share of U.S. investor assets in index mutual funds and index ETFs has climbed to over 50% of all long-term fund assets. Because these funds typically charge far lower fees than actively managed funds, Warren Buffett famously said that, if they ever put up a statue of the person who has done the most for American investors, it would be of Jack Bogle.

I did the calculations on the back of an envelope. The typical investor might be $19,000 poorer if Jack Bogle had never existed, for every $100,000 they have invested over 10 years, just from fees. That assumes identical market returns but a 0.04% vs 1.00% fee.

As one finance expert put it, "What Gutenberg was to the printing press, Henry Ford to the automobile, and Shakespeare to the English language, Jack Bogle is to finance."

While Bogle did well in school overall, his first economics course at Princeton nearly derailed his future. He earned a D+ on the midterm and needed at least a C average to retain his scholarship. He recovered, graduated magna cum laude, and based his senior thesis on mutual funds. That thesis became the foundation for Vanguard.

Bogle wrote 12 books, but the best place to start is with The John C. Bogle Reader. It collects his three most influential investment books in a single volume: Don't Count on It, Common Sense on Mutual Funds, and The Little Book of Common Sense Investing.

If you're more interested in the origin story of Vanguard and Bogle’s vision, then read Bogle’s Stay the Course: The Story of Vanguard and the Index Revolution. It's a fascinating and surprisingly gripping story.

Despite founding a firm that now manages over $7 trillion, Bogle was not a billionaire. He structured Vanguard as a mutual ownership company, meaning its profits went back to the investors, not to outside shareholders or to Bogle himself. He lived modestly and died in 2019 at the age of 89, with a personal net worth of around $80 million.

✦ Watch for tomorrow’s newsletter in your inbox.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter. Quotes may be edited slightly for clarity. Images represent our best effort. Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.