The Most Boring Way to Beat the Market

Value stocks are about as exciting as watching grass grow. But have you ever noticed just how much your grass grows in a week?

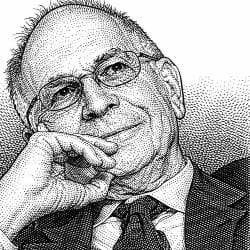

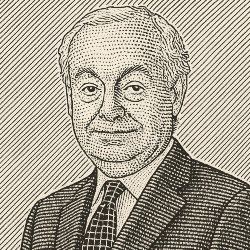

— Christopher Browne

Christopher Browne was value investing royalty. His father was a partner at what would become Wall Street’s original deep-value brokerage: Tweedy, Browne. Christopher followed in his footsteps and spent his entire career at the firm.

Founded in 1920, Tweedy, Browne traded in unloved and underpriced companies. The original founder, Bill Tweedy, considered his firm to be more thrift shop than a brokerage.

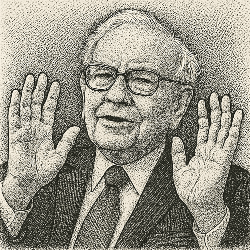

Tweedy, Browne's focus on bargains made the company popular with three of the greatest investors in history: Benjamin Graham, Walter Schloss, and Warren Buffett. In fact, Buffett used the brokerage to buy struggling little Berkshire Hathaway, which he has since transformed into the holding company for his vast investment empire.

When Christopher Browne took over from his father's generation in the 1990s, he consistently outperformed benchmarks. That success has continued. As of June 30, 2022, the Tweedy, Browne International Value Fund reported an 8.28% annualized return since its June 1993 inception. That was about 220 basis points above the hedged MSCI EAFE index over the same period.

Want to learn more about how Christopher Browne beat the market by watching grass grow? Start with his short and timeless guide, The Little Book of Value Investing.

✦ Watch for tomorrow’s newsletter in your inbox.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter. Quotes may be edited slightly for clarity. Images represent our best effort. Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.