Thomas Rowe Price Practically Invented Growth Investing

I can't guess the stock market. Change is the investor's only certainty.

— T. Rowe Price

You might think of T. Rowe Price as a mutual fund company, but Thomas Rowe Price, Jr. was first a man and one of America's most eminent investors. The T. Rowe Price Growth Stock Fund, which Price launched in 1950 with an investment in IBM, returned a compound annual growth rate of 15.3%. An initial $1,000 in this fund would become $22,837 by the end of 1972.

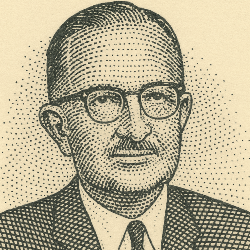

Author John Train described Price as a thin man with sad eyes, a dark moustache, and a knowing, tired, and somewhat grim smile. At 82 years of age and long retired, Price still rose every day at 5:00 A.M. He also still kept an agenda for each day, always checked off the items in the order they were listed, and never took up anything not listed. Price died in 1983 aged 85.

During his career. Price gave his name not just to a company but also to a whole philosophy of investing which was called “the T. Rowe Price approach.” Practically alone, Price popularized growth stocks at a time when most investors considered stocks to be cyclical investments.

Even the amateur investor who lacks training and time to devote to managing his investments can be reasonably successful by selecting the best-managed companies in fertile fields for growth, buying their shares, and retaining them until it becomes obvious that they no longer meet the definition of a growth stock.

— T. Rowe Price

These lines encapsulate the core of Price’s growth stock philosophy. He advised investors to find "fertile fields for growth,” such as an industry that is still enjoying its growth phase, and to select the one or few most promising companies win that field.

While he limited trading to avoid having to pay enfeebling taxes on gains, he didn’t believe in holding shares for a lifetime but only until the company no longer qualified as a growth prospect. Industries and corporations have life cycles, Price believed. Investors could earn the most profit with the least risk by owning shares during a company’s early stages of growth. At maturity, a company offers less opportunity and greater risk.

By 1965, Price believed that growth stocks were becoming overpriced. He slashed his investments in them and shifted to bonds, gold, and other resources stocks. Wall Street chuckled at T. Rowe Price (the man) recommending against what had come to be called “T. Rowe Price stocks.”

Over the next 10 years he made a substantial profit, while those who had stuck with Price’s old strategy faced disaster in 1974 as many growth stocks plummeted by as much as 80 percent.

To learn more about Thomas Rowe Price, Jr., the man and the investor, get a copy of T. Rowe Price: The Man, The Company, and The Investment Philosophy. It was written by a long-time colleague of Price's, Cornelius C. Bond.

Watch your inbox for tomorrow's My Daily Oracle, and visit www.mydailyoracle.com to read any posts you may have missed.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter. Quotes may be edited slightly for clarity. Images represent our best effort. Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.