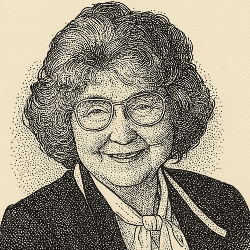

To This Grande Dame, Cold Hard Cash Is Always Mister Right

Geraldine Weiss was called the “Grande Dame of Dividends." Not only was she one of the first great female investors in the US, outperforming the market over decades. She also relied on her own innovative strategy to achieve this, using dividends to determine which shares to buy and sell.

You might call her approach "dividend value investing." Buy shares when the price is low and the dividend yield is high. Sell again when the price rises and the yield falls.

Weiss's approach worked. For nearly three decades, her portfolio compounded at 11.8% per year, compared to 11% for the Wilshire 5000 Total Market Index. That means Weiss delivered 30% more wealth to the investor following her rather than buying a total market index fund.

Folks who ignore the importance of dividends in making stock market selections are not investors. They are speculators. Speculators hope that the price of a stock will go up and reward them with profits. Investors know that stocks that pay dividends go up too. Meanwhile, they are getting a return on their capital. They believe the old adage: A bird in the hand is worth two in the bush.

— Geraldine Weiss

Before we go any further, let's explain a couple of things. A "dividend" is a payment made by a company to shareholders. The "dividend yield" is the size of the dividend in relation to the share price. If you can buy a share for a dollar and it pays 5 cents in annual dividends, its yield is 5%.

A stock is undervalued when the dividend yield is historically high. It is overvalued when the price rises and the yield becomes historically low. Each stock must be studied and evaluated according to its own unique profile of dividend yield, one that has been established over several investment cycles.

— Geraldine Weiss, Dividends Still Don’t Lie

Weiss looked for companies that might historically have typically paid out, say, 5%, but that are currently paying more. That would mean their dividends remained strong, even as their share prices had fallen. She considered such stocks undervalued.

On the flip side, Weiss sold the shares in her portfolio when the dividend yield dropped below its typical level.

It sounds simple, but you're still going to want to read one of her books. You can get her original Dividends Don't Lie in print, but you're probably better off with the more recent update by her successor.

The Weiss quotes in today's newsletter are pulled from her introduction to this volume, called Dividends Still Don't Lie: The Truth About Investing in Blue Chip Stocks and Winning in the Stock Market by Kelley Wright.

Missed a newsletter? Visit www.mydailyoracle.com for every recent edition, and keep an eye on tomorrow’s inbox as we continue to learn from the great oracles of finance.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter. Quotes may be edited slightly for clarity. Images represent our best effort. Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.