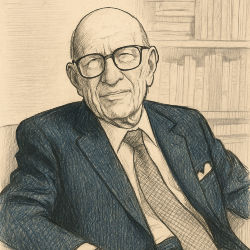

Walter Schloss Asks What It's Really Worth

Walter Schloss never craved the spotlight, yet he quietly built one of the most remarkable investing records of the 20th century. He didn’t predict market cycles or speak at conferences. He didn’t even go to college. What he did was buy cheap stocks and wait.

Born in 1916 and investing well into his nineties, Schloss worked under Benjamin Graham at the famed Graham-Newman Partnership before launching his own fund in 1955. He managed it for nearly five decades with a small team, a simple philosophy, and returns that outpaced the market.

"Price is the most important factor to use in relation to value."

— Walter Schloss

For Schloss, stocks were never just tickers or trades. Each was a partial ownership stake in a real business. If we don't know what a business is worth, we should not be buying its stock. (This is the classic value investor criticism of crypto. No one knows how to estimate what it's worth.)

Schloss liked to keep things concrete. He often started with book value. A company with zero debt trading at 80% of its book value would get his attention.

"Try to establish the value of the company. Remember that a share of stock represents a part of a business and is not just a piece of paper."

— Walter Schloss

That kind of thinking requires patience. It also requires restraint. Schloss wasn’t drawn to the exciting stories or soaring growth rates. He was more interested in neglected corners of the market—places where he could find assets selling for less than they were worth, often overlooked by others chasing momentum.

"Use book value as a starting point to try and establish the value of the enterprise. Be sure that debt does not equal 100% of the equity."

— Walter Schloss

Schloss reminds us that investing doesn't have to be complicated. It just has to be grounded in value.

For more insights from the great oracles of finance, visit www.mydailyoracle.com, and watch for the next post in your inbox.

To go deeper into this style of thinking, Walter Schloss’s investment approach is featured in numerous books about value investing, including Ronald Chan's The Value Investors: Lessons from the World's Top Fund Managers. Schloss himself frequently paged through an old copy (held together with Scotch tape) of Benjamin Graham’s classic The Intelligent Investor, the book that shaped Schloss’s entire career.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter. Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.