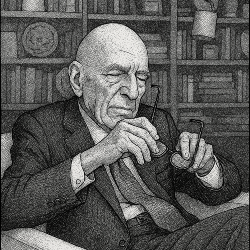

Walter Schloss' Light Work Habits Paid Off

Walter Schloss lived through seventeen recessions, starting with one during Woodrow Wilson's presidency. He never owned a computer, never emailed a spreadsheet, and got his stock prices each morning from the newspaper. And yet, his results as an investor rival the best in history.

Warren Buffett once called him a "superinvestor," and Schloss averaged a 16% total return after fees (he took 25% of profits) during five decades as a stand-alone investment manager, versus 10% for the S&P 500. He got these returns despite being what a friend called "a man of modest talent and light work habits."

"Have patience. Stocks don't go up immediately."

— Walter Schloss

Patience was one of his edges. Schloss bought because something was cheap, and then he waited until it reached fair value. The simple act of waiting can be brutally hard. But for Schloss, it was a built-in part of the process. If we’re investing based on intrinsic value, it only makes sense to allow time for that value to be recognized.

"Don't buy on tips or for a quick move. Let the professionals do that, if they can. Don't sell on bad news."

— Walter Schloss

Sometimes, Schloss got out of a position too quickly. He made 75% on his money after buying Lehman Brothers below its book value shortly after it went public in 1994, but Lehman then went on to triple in price.

For more reflections on timeless insights from the oracles of finance, visit www.mydailyoracle.com for anything you may have missed, and watch for the next post in your inbox.

To go deeper into this style of thinking, Walter Schloss’s investment approach is featured in numerous books about value investing, including Ronald Chan's The Value Investors: Lessons from the World's Top Fund Managers. Schloss himself frequently paged through an old copy (held together with Scotch tape) of Benjamin Graham’s classic The Intelligent Investor, the book that shaped Schloss’s entire career.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter. Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.