What High-Yield Savings Accounts Are Really for

One year of savings is my sweet spot advice for being prepared for major financial setbacks. And I want you to earn the most you can on your “safe” money.

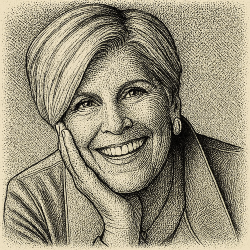

— Suze Orman

Personal finance oracle Suze Orman believes everyone should have sufficient cash on hand to cover an unexpected emergency.

She learned how important it is to put your money in a safe place when, as a young woman, she lost all her savings. Her financial advisor had lost it in speculative options trading. (Read the full story in "Suze Orman and Redemption.")

Orman says your first goal is to build up an "emergency" fund to cover three months of expenses. Then, if you're near retirement, she calls a one-year cash buffer her “sweet spot” for financial peace of mind.

The question is where to park that money. Stocks and property can earn more, but they can also swing down just at the moment you need liquidity. That’s why Orman suggests high-yield savings accounts.

High-yield savings accounts on average offer four-times higher interest rates than regular savings or checking accounts: 1.73% versus just 0.39%.

And those numbers are just averages. The high-yield accounts with the best yields have rates as lofty as 4.88%.

Orman says high-yield savings accounts aren't an investment, they are an insurance policy and give you a safe place to store cash so it is FDIC insured, protected against inflation, and easy to get your hands on.

That way, if financial trouble comes your way, you'll be prepared.

✦ Watch for tomorrow’s newsletter in your inbox.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter. Quotes may be edited slightly for clarity. Images represent our best effort. Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.