When Hoarding Is Smarter than Investing

The inducement to invest depends on expectations of profit. But these expectations are highly uncertain. Faced with irreducible uncertainty, hoarding is more rational than investing.

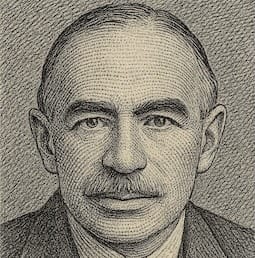

– John Maynard Keynes

This quote by Keynes's is still meaningful today. With stark levels of both political and market uncertainty, some investors are hoarding cash. And Keynes believed cash can be the more rational option if it helps you avoid loss while giving you the flexibility to buy whenever an opportunity arises.

With apologies to all the academics out there, John Maynard Keynes wasn't just a professor. During the Great Depression, he managed to build up a personal fortune of about $30 million though stock investing. He also outperformed the British common stock index by an annual average of 8 percentage points while managing the King's College endowment fund at Cambridge University, from 1921 to 1946.

That record nearly matches Warren Buffett's performance against the S&P 500. (Buffett beat the index by 9.6 percentage points between 1965 and 2024.)

Oh, and when he wasn't investing, Keynes helped create the post-World War II international economic system and made his economic theories the dominant strain of postwar economics in most of the world.

To learn what Keynesian insights you can apply to your portfolio, read Investing with Keynes: How the World's Greatest Economist Overturned Conventional Wisdom and Made a Fortune on the Stock Market, by Justyn Walsh.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult with a qualified financial advisor before making any investment decisions.

Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.