Li Lu: Where else would you find cheap stocks?

In my view, the biggest risk in investing is not the volatility of prices, but whether you will suffer a permanent loss of capital. Not only is the mere drop in stock prices not a risk, but also it may present an opportunity. Where else would you find cheap stocks?

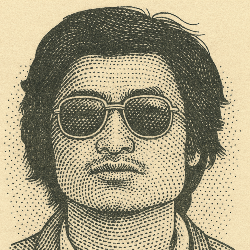

– Li Lu

Today's Oracle Bio:

Li Lu escaped China after the 1989 Tiananmen Square massacre and soon after discovered investing by walking into a lecture being offered by Warren Buffet. He is highly successful and known for his value investing approach, particularly in high-growth companies. Lu has achieved a 30% compound annual return since 1998 and is recognized for his early and lucrative investment in BYD. He may have earned returns of more than 5600% from BYD alone, between 2002 and 2021.

Book Highlight:

The best place to learn more about Li Lu's investment strategies is in the free writings shared on the publications page of the website for Himalayan Capital, his fund company.

Thought of the Day:

Lu reveals that investing is meritocratic. You can succeed even if you start, literally, with nothing. Like Benjamin Graham, Warren Buffett, and Charlie Munger, he seeks undervalued companies with a margin of safety and holds them long-term so the underlying businesses can compound.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult with a qualified financial advisor before making any investment decisions.

Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.