Why Some Investors Can't Cut Their Losses

One of the best-known Wall Street sayings is, “You never get poor by taking a profit.” It would seem to follow that it is also a good idea to sell losing shares before they fall even further. Yet, few investors act that way.

Investors hate to take losses, because, tax considerations aside, a loss taken is an acknowledgment of error. Loss aversion combined with ego leads investors to gamble by clinging to their mistakes in the fond hope that some day the market will vindicate their judgment and make them whole.

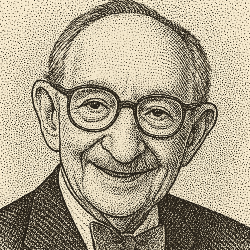

— Peter L. Bernstein

Bernstein was a prominent American financial historian and economist who managed billions of dollars in assets. Unlike many economists, he had no illusions about the irrationality of human decision-making.

Some investors use a stop-loss order to remove emotion from decision-making when a stock is falling. You buy a stock and immediately place a stop-loss order at a price point below the purchase price, perhaps 10% below. If the stock price falls to that level, the order is automatically triggered, and the shares are sold without you having to reckon with your mistake.

Reading Bernstein is a pleasure because of his clarity of thought. Today's quote comes from Bernstein's chapter in The Handbook of Risk, edited by Ben Warwick. But even more than that, I would recommend his other influential books on risk and finance, especially the international bestseller Against the Gods: The Remarkable Story of Risk.

Missed a newsletter? Visit www.mydailyoracle.com for every recent edition, and keep an eye on tomorrow’s inbox as we continue to learn from the great oracles of finance.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter. Quotes may be edited slightly for clarity. Images represent our best effort. Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.