Would You Buy a Bond That Never Stops Paying Interest?

Yale University has a $40.1 billion endowment, but one of its most unconventional and unexpected assets is a perpetual bond that has been paying interest for more than 300 years.

Yale's bond was issued in 1648 by a Dutch water board, Hoogheemraadschap Lekdijk Bovendams, to finance dike work near the Lek River in the Netherlands.

The bearer shall receive annually the interest, so long as the dike shall exist and require maintenance.

— From the contract to Yale’s 1648 bond

With no maturity date, perpetual bonds pay interest forever. Italian cities and states like Venice, Florence, and Genoa issued the first of these bonds, calling them "monti," because they were a heap, or mountain, of existing debt all rolled into a single new and perpetual instrument.

The monti are safe and perpetual, for the Commune never redeems them, and the interest is certain.

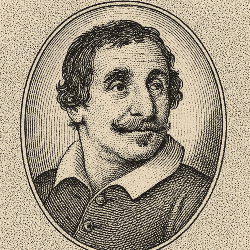

— Francesco Balducci Pegolotti

Any conservative investor today who values the safe cash flow that comes from dividends or annuities might wish they could acquire some of these eternal money makers.

There are downsides, however. One is that they aren't inflation-protected. The Dutch bond owned by Yale originally paid the equivalent of about $10,000 per year in today's money. After 377 years of inflation, its actual annual yield is just under $15.

Another downside is that the perpetuals, or “perps,” issued today have become complicated investments that are seldom available to small retail investors. Nor are today's perps truly perpetual, as the issuers can redeem them within certain time limits spelt out in their terms.

Find Out More

For a fascinating short video in which you can see the actual 1648 bond Yale owns, watch this YouTube video by Tom Scott.

The 14th-century Florentine merchant quoted above, Francesco Balducci Pegolotti, was a senior businessman who dealt directly was King Edward II of England. His quote comes from the handbook he composed for merchants engaging in international trade at the time, Pratica della Mercatura. You can read a free English excerpt courtesy of the University of Washington.

If you're fascinated by mediaeval European business and finance, check out Power and Profit: The Merchant in Medieval Europe by Peter Spufford. Another, shorter volume is The Commercial Revolution of the Middle Ages, 950–1350 by Robert S. Lopez.

Did you miss a newsletter? Visit www.mydailyoracle.com for every recent edition, and keep an eye on tomorrow’s inbox as we continue to learn from the great oracles of finance.

Disclaimer: This newsletter is for informational purposes only and does not constitute financial advice. Please consult a qualified financial advisor before making any investment decisions. Links on this page may be affiliate links, meaning your purchases help support this newsletter. Quotes may be edited slightly for clarity. Images represent our best effort. Copyright © 2025 mydailyoracle.com. All rights reserved.

No spam, no sharing to third party. Only you and me.